Most homeowners insurance guidelines include structural injury and reduction of non-public property, or contents, around a price of about 50% on the protected worth of the house.

Have your home inspected so knowledgeable can overview the extent of the problems and provide an estimate for the price of restore. For those who make any repairs oneself, be sure to hold all receipts as well as other significant documents at hand around on your insurance business for possible reimbursement.

Impartial insurance agents are kind of such as Google of insurance quotes. You notify them That which you’re seeking, and they bring in the final results.

Homeowners insurance handles fires, protecting both the home itself and your personal property. Actually, the home insurance coverage we know right now started out being a fire insurance coverage, with fire getting the principle peril insured in opposition to.

Indemnity InsuranceIndemnity InsuranceIndemnity insurance refers back to the insurance protection that safeguards an insured versus the financial losses arising from professional carelessness.

Some regular homeowners insurance procedures involve coverage for fire, However they might not be considerable adequate for many homeowners. If an insurance plan excludes coverage for fire injury, a homeowner might require to invest in separate fire insurance—especially if the house has valuable things that can't be protected with conventional protection.

Actually, fire is the original peril that specific forms of insurance, which include homeowners insurance, were being meant to protect against. An independent insurance agent can help you evaluation your existing coverage to ensure you have adequate fire protection.

Our Bafe accredited engineers can provide a comprehensive fire basic safety equipment installation assistance to incorporate comprehensive fire alarm programs, unexpected emergency lights and portable fire battling equipment.

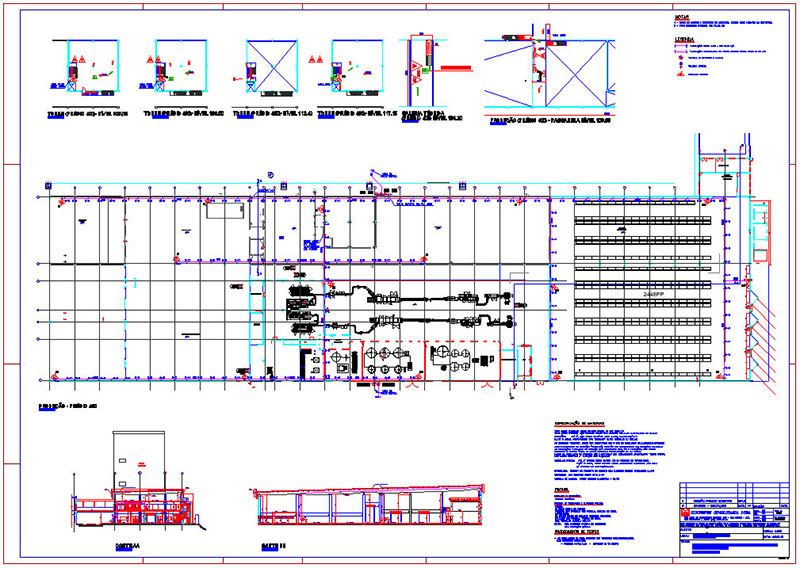

Considering the fact that fires usually end in a complete loss, you may want to look at an prolonged replacement Expense endorsement in your peace of mind. Extended alternative Charge improves your dwelling protection limit an extra 25% to fifty% from the party your home’s projeto de prevenção e combate à incêndio rebuild Expense exceeds your coverage boundaries.

Coinsurance would be the assert quantity an insured ought to pay soon after Conference deductibles and can also be the level at which an operator must safeguard assets.

Our trainings are carried out by remarkably certified personnel educated in numerous disciplines, with huge expertise in unexpected emergency response methods within the firefighting and pre-hospital field, which guarantees the standard of the conferences.

Every time a person or a company home hopes to get its house insured, a proposal type is duly loaded. The form has columns for specifics of the house to be insured. The main points from the assets, its area and contents are given from the proposal. projeto de segurança contra incêndio e pânico The insured ought to give accurate answers to many of the queries in the shape. Fire insurance contract is predicated on mutual faith. On receipt on the proposal the underwriter assesses the possible reduction linked to the proposal. The proposal could be recognized on its receipt or even a surveyor may very well be sent to evaluate the proposal. In the event the underwriter accepts the proposal, the contract arrives into existence. Sometimes a cover Observe is issued instantly plus the plan is sent in a while. A canopy note binds the insurance company to indemnify the danger.

An independent insurance agent can explore your preferences along with you and assist you identify if expanding your plan's boundaries or incorporating an additional fire insurance plan is the right choice.

Much like how we’ve viewed insurance businesses exclude wind and hurricane hurt from insurance policies in higher-chance coastal communities, insurers are possibly excluding wildfire damage from coverage or not insuring residences in high-threat parts completely.